Don't get fooled by scammers: RACQ

According to the Australian Competition and Consumer Commission, Australian businesses lost more than $14 million to payment redirection scams last year, and average losses so far in 2021 were more than five times higher than the same period in 2020.

RACQ spokesperson Lucinda Ross said the amount of money lost to scammers in recent years had been increasing steadily with scams becoming more sophisticated.

“Anyone can become a victim. We’re hearing about it all too often from our members who’ve told us that they’ve been targeted by scams including phishing, romance and online shopping scams,” Ms Ross said.

“Victims are often contacted through emails, phone calls, text messages and social media.

“Sadly, some members have been tricked by a ‘boyfriend’ or ‘girlfriend’ they met online. Other times scammers have posed as legitimate organisations like banks, insurance companies or the Government to gain their trust.”

Ms Ross said there were a few simple things Queenslanders could do to avoid getting conned.

“Don’t give out personal information, including your financial details, to anybody you haven’t met in person, no matter who they claim to be,” she said.

“Make sure you’re wary of any deals that seem too good to be true, arrive unsolicited in your inbox, or through a text or call to your phone.

“Be cautious when entering your card details online and remember your bank will never ask you for your PIN or internet banking password. They will also never ask to gain remote access to your computer or device.”

Types of scams reported by RACQ members:

- Payment redirection scams: Scammers impersonate a business or its employees via email and request money, saying it is owed to a legitimate business, and then direct the vulnerable person to send money to a fraudulent account.

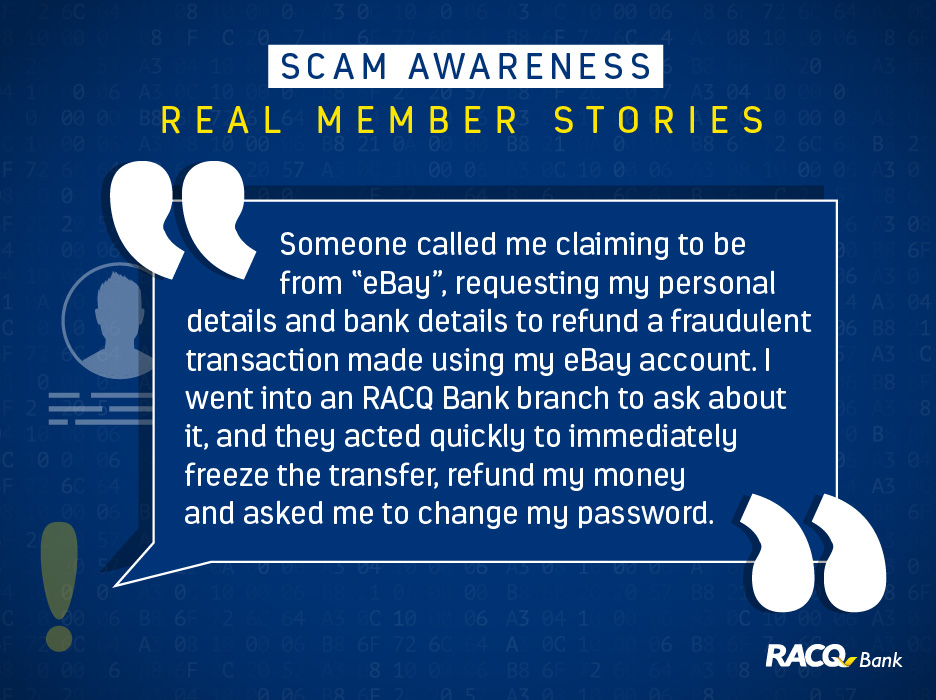

- Remote access scams: Remote access scams start with a phone call from someone pretending to be from a legitimate company, such as your internet provider, telecommunications, a bank, government agency or shopping merchants such as eBay or Amazon. They request access to a computer, mobile or tablet saying they can ‘assist, fix or protect’ you.

- Phishing scams: This is when a scammer tries to steal your personal information. The scammer pretends to be a company you know and trust, like a bank or an internet provider, and asks for your personal information. The scammer may contact you by email, phone or text, or on social media.

- Online shopping scams: Scammers pretend to be real online shops, either with a fake website, or a fake ad on a genuine retail site. Fake online shopping sites will often request unusual payment methods such as upfront payment via money order, wire transfer, international funds transfer or gift cards.

- Relationship and dating scams: A scammer forms a relationship with you over time to get money or gifts. They may ask you to transfer assets into their name or ask to become a beneficiary of your will. Often, they’ll ask for money to fix a health, travel or family problem.

- Investment scams: The scammer claims to be a stockbroker or portfolio manager offering financial or investment advice. They’ll ask you to hand over money for an investment opportunity that may, or may not, be real, then keep your money. They often offer returns that are too good to be true or returns well above what should be expected from similar investments. This also applies to Crypto currency.

For more information on tips for avoiding a scam, or other information on ways to improve how you manage your money, visit RACQ’s Financial Wellbeing Hub.

Related topics

Things to note

The information in this article has been prepared for general information purposes only and is not intended as legal advice or specific advice to any particular person. Any advice contained in the document is general advice, not intended as legal advice or professional advice and does not take into account any person’s particular circumstances. Before acting on anything based on this advice you should consider its appropriateness to you, having regard to your objectives and needs.