RACQ Bank’s accreditation

We make every effort to keep you financially safe, we’re also accredited by APRA and have Government guaranteed deposits. So you can be extra confident that your money is secure with us.

Our APRA accreditation

RACQ Bank is an APRA accredited Authorised Deposit-taking Institution (ADI). ADIs are corporations which are authorised under the Banking Act 1959 and include:

- Banks

- Building societies

- Credit unions

All ADIs are subject to the same Prudential Standards but the use of the names 'bank', 'building society' and 'credit union' is subject to corporations meeting certain criteria. Learn more about APRA accreditation at apra.gov.au.

Financial Claims Scheme

The Financial Claims Scheme (FCS) is an Australian Government scheme that provides protection and quick access to deposits in banks, building societies and credit unions in the unlikely event that one of these financial institutions fails. Under the FCS, certain deposits are protected up to a limit of $250,000 for each account holder at any bank, building society, credit union or other authorised deposit-taking institution (ADI) that is incorporated in Australia and authorised by the Australian Prudential Regulation Authority (APRA). More information can be found here.

How We Keep You Financially Safe

At RACQ Bank, we implement several leading and proven security measures across our various products and platforms to keep you financially safe. Here’s our bank security approach to keep you safe:

Visa Zero Liability

With Visa's Zero Liability policy, you won’t be held responsible for fraudulent charges or unauthorised purchases made with your RACQ Bank Visa Debit card. So you’ll be able to use your card to shop with total confidence, knowing you’ll be protected against unauthorised use.

Visa's Zero Liability policy covers Australian and New Zealand-issued cards and does not apply to ATM transactions, transactions not processed by Visa or certain commercial card transactions. Cardholders should notify their issuer promptly of any unauthorised Visa use. For Visa's Zero Liability Terms and Conditions, visit VISA Australia

Visa-verified prompts on purchases

Verified by Visa helps protect you against unauthorised card use when you shop at participating retailers, giving you confidence when shopping online with your RACQ Bank Visa Debit card. At participating merchants, you may be asked to verify your identity – this ensures that the owner of the card is the person completing the transaction.

Internet banking encryptions

We use a range of security measures to assist in protecting your personal banking information. These measures include data encryption and firewalls which together helps to provide some of the best security available to keep you safe online.

Two-factor Authentication

Known as 2FA for short, two-factor authentication is a security measure on our internet banking platform. It requires not only a username and password but also an extra piece of information that only you know to enhance financial security levels even further.

How to keep yourself financially safe

With threats from scammers becoming more sophisticated and prevalent every day, it’s also important that you do whatever you can to help keep yourself and your finances secure. Take a look at the following to see how you can stay more alert and vigilant when accessing your money, both online and out in the real world.

ATM safety

While it may seem obvious, there are a number of things you can do to stay safe when using an ATM. Firstly, be sure to cover the keypad when entering your PIN. Also, look for any tampering around the card slot that may indicate a card skimmer has been installed. And don’t count your cash at the ATM – hold off until you’re in a safe place.

Passwords

We all know how crucial it is to keep our passwords private, but it’s surprising how much fraud occurs due to lapses in password security. So always remember to keep your internet banking password safe, and try to make it as unique as possible. The same goes for your card PIN, and of course never keep your PIN close to (or written on) your card.

Email scams

There are countless email scams out there asking people to supply their bank account details or send money online. Sometimes it’s claiming to be an offer of a big prize. Or an amount you owe to the tax office. Or a friend or relative in financial stress. Before you ever send money or provide you account details to anyone after receiving an email, stop and check first to see if it’s legitimate. If it seems to good to be true, it probably is.

If you have any concerns or queries regarding the legitimacy of an email or a request for funds or account information, please contact us for advice before proceeding.

Social media

Like email scams, there are cases where people have been targeted by scammers on social media platforms. Again, they may ask for your account details to deposit an unbelievable (very unbelievable) amount of money, or to send money online. And again, these should be treated with caution and either ignored or investigated carefully to see if they are in fact legitimate.

The Little Black Book of Scams - ACCC

The ACCC have released The Little Black Book of Scams, a handy reference guide to the most common scams targeting Australians, how to recognise a scam and key tips and advice on how to protect yourself against a scammer. Download your free digital copy here.

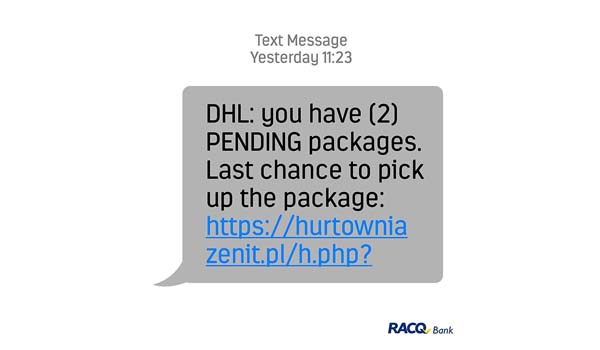

FluBot Messages

We are aware of text messages circulating which contain links to malicious software. Current versions of the text messages advise of the recipient receiving a voicemail/missed call notification or parcel delivery information. Please see example below.

If the recipient clicks on this link, it may download and install software that has the ability to compromise your device including access to sensitive information. This could include, however not limited to; send/receive text messages, download the contacts list, access bank account information and complete unauthorised transactions.

DO NOT to click links you may receive on mobile devices even if they do resemble your organisations brand and or banking login page.

If you have clicked any suspicious links, or notice any unusual activity on your internet banking, please call us immediately on 13 1905.

For further information on this scam, please visit www.scamwatch.gov.au.

Current security alerts and warnings

We realise it can be hard for you to stay on top of all the potential security and safety issues that may arise. So we’re dedicated to providing you with these details as soon as we’re aware of them, and letting you know what you can do to avoid being affected.

Current warnings

January 2022: We have become aware of a security risk with an online merchant that some members have transacted with. Card details at risk include card holder name, card number, expiry date and CVV. All cards identified as potentially at risk have been blocked and new cards issued. Impacted members have been contacted.

7 June 2019: Australians losing money to investment scams - read the full details at staysmartonline.gov.au

Microsoft and Telstra Scams - learn more from scamwatch.gov.au

ATO scams - visit ato.gov.au for more information

Binary trading - find out more from scamwatch.gov.au

Coles and Woolworths gift card scams - read more at smartcompany.com.au

While you're here

Contact us

Need help or would like to know more? RACQ Bank offers many convenient ways for you to get in touch with us.

Bank security FAQs

Things to note

Banking and loan products issued by Members Banking Group Limited ABN 83 087 651 054 AFSL/Australian credit licence 241195 trading as RACQ Bank. Terms, conditions, fees, charges and lending policies apply. This is general advice only and may not be right for you. This information does not take your personal objectives, circumstances or needs into account. Read the disclosure documents for your selected product or service, including the Financial Services Guide and the Terms and Conditions, and consider if appropriate for you before deciding.

Except for RACQ Bank, any RACQ entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Cth). That entity’s obligations do not represent deposits or other liabilities of RACQ Bank. RACQ Bank does not guarantee or otherwise provide assurance in respect of the obligations of that entity, unless noted otherwise.