What is PayTo?

From phone bills to your gym membership – PayTo gives you more control over payments from your bank account, to help make life admin that little bit easier.

PayTo is a fast and secure payment option. Use your bank account to pay your way:

- You can view and manage your PayTo agreements via your internet banking

- You can see payments you’ve set up from your bank account in one secure place

- You can choose to use your PayID or BSB and account number,

making it easy to set up payments on the spot

With PayTo, you will have more visibility and control over your payment arrangements through an enhanced, digital experience.

When will PayTo be available for use?

You may notice the new ‘payment agreements’ option in your internet banking, however PayTo functionality will only be available from 1 August 2022.

What are the benefits to using PayTo?

-

You will have greater control and visibility over your accounts' PayTo payments

-

The flexibility to create, amend and cancel payments through your internet banking

-

The ability to pre-authorise payments in Real-Time

Who can use PayTo?

A PayTo agreement can be set up from any of the following types of accounts:

-

Transaction accounts

-

Savings accounts

-

Overdraft Accounts

How to manage your PayTo

Managing your PayTo is as easy as:

-

Log in to your internet banking

-

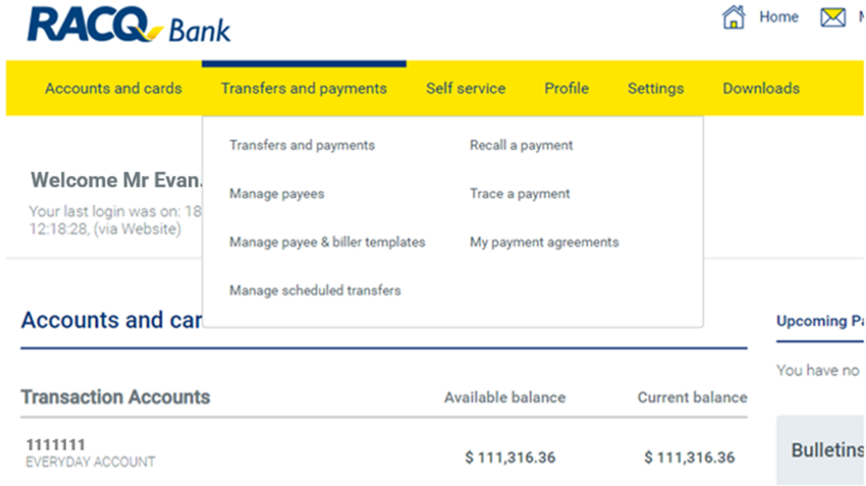

Select Transfers and payments – 'My payment agreements'

-

Then select 'Amend', 'Cancel', 'Pause' or 'Resume'

Remember you can view, amend or stop payments at any time by logging in to your internet banking

If you need assistance, contact us.

PayTo FAQs

Things to note

Banking and loan products issued by Members Banking Group Limited ABN 83 087 651 054 AFSL/Australian credit licence 241195 trading as RACQ Bank. Terms, conditions, fees, charges and lending policies apply. This is general advice only and may not be right for you. This information does not take your personal objectives, circumstances or needs into account. Read the disclosure documents for your selected product or service, including the Financial Services Guide and the Terms and Conditions, and consider if appropriate for you before deciding.

Except for RACQ Bank, any RACQ entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Cth). That entity’s obligations do not represent deposits or other liabilities of RACQ Bank. RACQ Bank does not guarantee or otherwise provide assurance in respect of the obligations of that entity, unless noted otherwise.