Storm Season Explained: Insurance

Don’t let warm sunny days lure you into a false sense of security – summer weather in Queensland can be unpredictable and extremely destructive.

In RACQ’s latest Storm Season Explained episode, Chief Executive Insurance Trent Sayers explains that as we progress further into summer, it’s crucial that Queenslanders are well prepared.

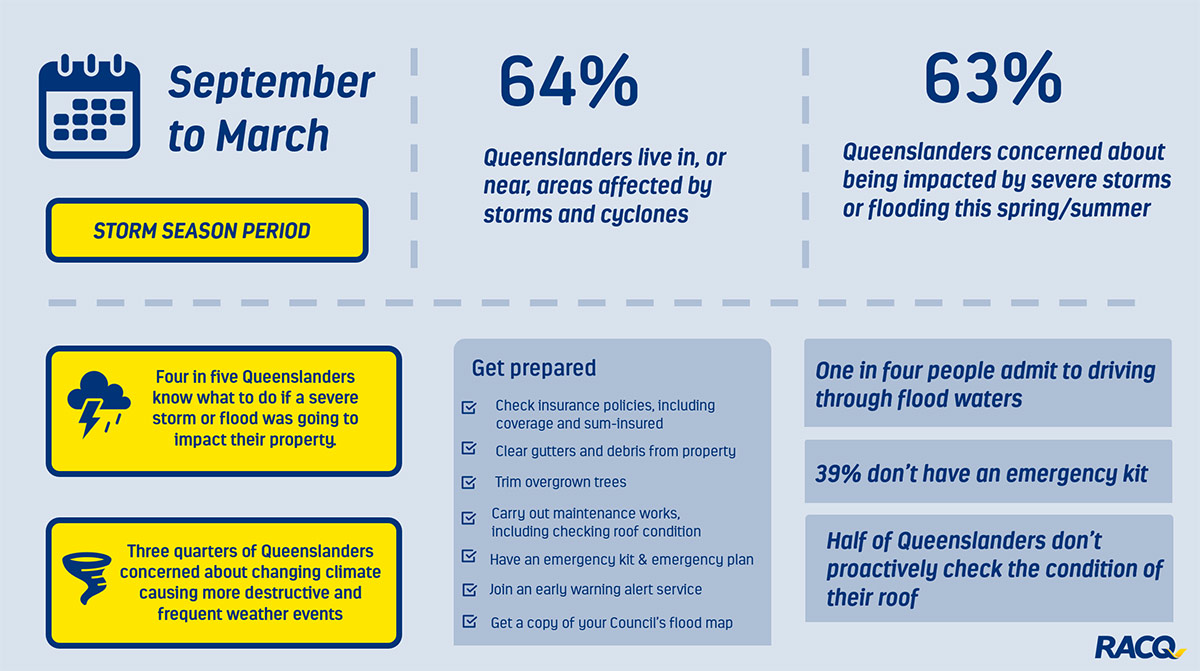

“Storm season typically runs from September to March, meaning we’re in the middle of the high-risk time for severe weather events,” Mr Sayers said.

“It’s critical that everyone is as ready as they can be for a weather emergency and aren’t leaving things until the last minute when the rain has started falling or a bushfire is on the doorstep.

“Being prepared is not only about protecting your home but also you and the people you care about.

“Carrying out maintenance work around the home is a really important step in helping to prevent damage and can make recovering from a weather event easier.

“Simple things like checking your roof to make sure there are no loose tiles or sheeting, cleaning your gutters to allow water run-off, cutting back trees, clearing debris from your yard and making sure there’s nowhere for water to pool around buildings.

“Having an emergency kit and emergency plan are also essential, but are concerningly often overlooked, putting people at increased risk.”

Mr Sayers said the new year also serves as a timely reminder for people to check their insurance policy.

“As our lives continue to change, we need to make sure our insurance remains up-to-date to suit our needs, and the level of cover is appropriate for our living arrangements,” he said.

“This can include checking if your policy covers things like flooding, that your sum insured amount will cover the cost of rebuilding or replacing your home and/or contents, if any renovations are covered and if your car is insured as an agreed value, that the amount is in line with the cost of your car in today’s market.”

Mr Sayers also reminded Queenslanders that mould may not be covered by insurance policies.

“Our humid climate is the perfect breeding ground for mould, particularly in closed up and poorly ventilated areas,” he said.

“Mould damage to a home or its contents isn’t covered by RACQ Household Insurance, unless it occurs within 21 days of damage caused by an insurable event, like a storm or flood.

“That’s why maintaining your home and garden is important. Insurance is there to cover sudden and unexpected issues.”

RACQ’s Chief Executive Insurance Trent Sayers is one of several leading experts featured in our Storm Season Explained series. This series provides a deep dive into a range of key issues to help inform and educate Queenslanders ahead of, and during, storm season.

Things to note: The information in this article has been prepared for general information purposes only. Advice contained in the document is general advice, not intended as legal advice or professional advice and does not take into account any person’s particular circumstances. Before acting on anything based on this advice you should consider its appropriateness to you, having regard to your objectives and needs.

Disclaimer: Insurance products issued by RACQ Insurance Limited ABN 50 009 704 152. Conditions, limits and exclusions apply. This is general advice only and may not be right for you. Consider the PDS, SPDS and TMD available at racq.com

The below data and information is from RACQ's 2022 Attitudes Toward Storm Season Report.