Caravan industry under scrutiny

ACCC report reveals unsatisfactory treatment of caravan customers.

Caravan owners have been reminded of their consumer rights following a report into the industry which found widespread misrepresentation by suppliers and delays in the delivery and repair of vans.

The Australian Competition and Consumer Commission’s (ACCC) New caravan retailing report highlights concerns in the new caravans market and guides businesses about their obligations to comply with Australian Consumer law.

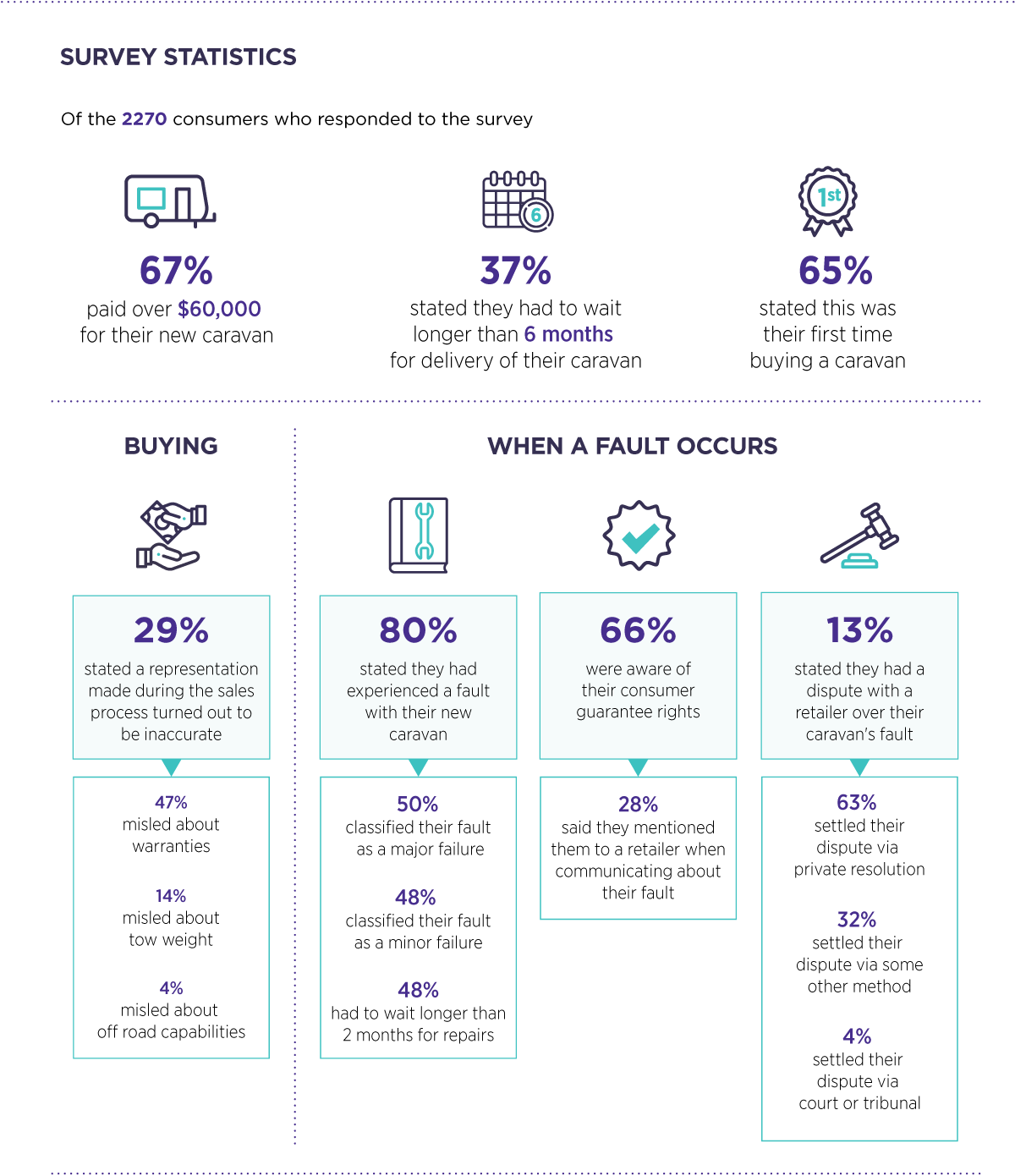

In an ACCC survey of 2,270 caravan owners, 80% reported having experienced problems with their new caravan.

The number of consumer complaints to the ACCC about the caravan industry continues to rise, reaching more than 1,300 in the past five years.

ACCC Deputy Chair Delia Rickard said a caravan could represent the buyer's significant financial and emotional investment.

“Some people save for years in anticipation of purchasing and travelling in a caravan. If something goes wrong, the harm can be significant,” Ms Rickard said.

The ACCC said under Australian Consumer Law if your caravan failed to meet one or more consumer guarantees, for example, it was not of acceptable quality or did not match a description made by a supplier, then you were entitled to a remedy – either a replacement, refund or repair from the supplier.

It also said it was important to note that multiple minor failures could be considered a major failure, which entitled customers to their choice of a refund or replacement.

Consumers unsatisfied

Many consumers reported to the ACCC that when they experienced a failure with their caravan, they could not obtain a remedy or that the remedy provided did not fully address the failure.

“We are very concerned by these reported failures to comply with obligations under the Australian Consumer Law, and the impact that these failures have on consumers who have purchased a caravan which develops a fault,” Ms Rickard said.

“Consumers need to be confident that when they make a significant financial purchase like a caravan, they will be able to get a refund, replacement or a repair if there is a failure.

“It is the ACCC’s view that it is reasonable to expect a new caravan won’t develop a major fault within the first several years of use.”

The ACCC was also concerned that many consumers believed suppliers had misled them during the sales process or when problems with their caravan arose.

“If your caravan has a major or minor consumer guarantee failure you may be entitled to a remedy even if the warranty provided by the business has expired,” Ms Rickard said.

Source: ACCC

Timely reminder of law

Caravan Industry Association of Australia (CIAA) CEO Stuart Lamont said the ACCC report was a timely reminder of supplier and manufacturer obligations under Australian Consumer Law.

“While the vast majority of industry businesses understand and adhere to their consumer obligations and supplier indemnification responsibilities under the Australian Consumer Law, there always remain opportunities for individual improvement,” Mr Lamont said.

“The purchase of a caravan is not only a large financial purchase but one which is tied with much emotion, and is highly valued and aspirational.

“The national body will work closely with industry in assisting them to further understand their obligations in dealing with consumers, and industry businesses along the supply chain, so that consumer expectations are met.”

The CIAA said the industry had been under enormous pressure because of unprecedented demand from Australians looking to experience the caravanning and camping lifestyle and supply issues generated out of COVID-19 labour shortages and supply chain delays, primarily out of China.

Consumers also reported they believed suppliers made misrepresentations about their caravan’s performance capabilities and tow weight.

“Reports of misleading representations about caravan’s tow weight and other important performance capabilities are particularly worrying given the grave safety implications for consumers,” Ms Rickard said.

“The ACCC will investigate and take enforcement action against suppliers and manufacturers we believe may have misled consumers.”

Delivery and repairs delayed

The report also found that many consumers experienced delays in the delivery of their new caravan or for repairs to their existing caravan, some of which related to COVID-19 supply chain disruptions and recent increased demand.

“We expect that suppliers will be upfront with consumers about the timeframe for delivery of their caravan and any potential delays during the sales process and continue to proactively communicate until delivery,” Ms Rickard said.

The ACCC has released guidance for buying a new caravan to help consumers and businesses understand their rights and obligations when buying and selling caravans.

The ACCC has also developed information for the caravan industry to assist in complying with the requirements of consumer and competition laws.

RACQ Comprehensive Caravan and Trailer Insurance

Related topics

Things to note

The information in this article has been prepared for general information purposes only and is not intended as legal advice or specific advice to any particular person. Any advice contained in the document is general advice, not intended as legal advice or professional advice and does not take into account any person’s particular circumstances. Before acting on anything based on this advice you should consider its appropriateness to you, having regard to your objectives and needs.

Insurance Products (excluding Travel Insurance) are issued by RACQ Insurance Limited ABN 50 009 704 152 (RACQI>) and arranged by RACQ Distribution Services Pty Ltd (RDS) ABN 35 116 361 650, AFSL 567130 and RDS' authorised representatives (including RACQ Operations Pty Ltd ABN 80 009 663 414, AR No. 234978 (RACQO)). Conditions, limits and exclusions apply.

Any advice provided by RDS and RACQO is general advice only and does not take into account your personal objectives, financial situation or needs and you will need to consider whether the advice is appropriate for you. Read the Product Disclosure Statement (PDS) before making a purchase decision on the product. You can also access our Target Market Determinations on this website.

RDS receives a commission from RACQI for the policies it arranges. RACQO receives fees paid for services it provides to RDS. Further details about remuneration are available on request prior to purchasing.

Banking and loan products issued by Members Banking Group Limited ABN 83 087 651 054 AFSL/Australian credit licence 241195 trading as RACQ Bank. Terms, conditions, fees, charges and lending policies apply. This is general advice only and may not be right for you. This information does not take your personal objectives, circumstances or needs into account. Read the disclosure documents for your selected product or service, including the Financial Services Guide and the Terms and Conditions, and consider if appropriate for you before deciding.

Except for RACQ Bank, any RACQ entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Cth). That entity’s obligations do not represent deposits or other liabilities of RACQ Bank. RACQ Bank does not guarantee or otherwise provide assurance in respect of the obligations of that entity, unless noted otherwise.

RACQ Bank subscribes to the Customer Owned Banking Code of Practice which establishes higher standards than the law requires. The Code reflects modern consumer expectations and developments in approaches to issues such as consumer vulnerability, guarantors, and supporting customers through financial hardship. Please read our Customer Owned Banking Code of Practice page for more information.

RACQ Operations Pty Ltd (ABN 80 009 663 414 AR 000234978) and Members Travel Group Pty Ltd (ABN 45 144 538 803 AR 000432492) are acting as an Authorised Representative of the issuer of the insurance, Tokio Marine & Nichido Fire Insurance Co., Ltd. (ABN 80 000 438 291 AFSL 246 548). Any advice set out above is general in nature only, and does not take into account your objectives, financial situation or needs. Before purchasing any travel products, please consider the RACQ Travel Insurance Product Disclosure Statement (PDS) and the Target Market Determinations (TMDs) that apply to these products. Whilst the PDS outlines the Terms and Conditions of these products, the TMDs outline the intended class of customers that comprise the target market for these travel products. This will allow you to consider which products best suit your objectives, financial situation and needs and consider the products appropriateness to your personal circumstances. TMDs also outline matters involving the distribution and the review of these products. The PDS, Supplementary PDS and TMDs for each travel product can be found here.