Road rage ramping up across Queensland

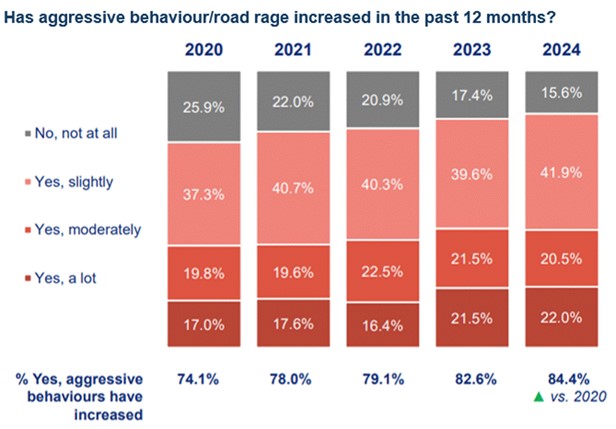

The number of motorists who believe road rage has increased on our roads has surged by more than 10% since 2020, according to RACQ’s latest Annual Road Safety Survey.

.jpg?h=667&iar=0&w=1000&rev=6c9667b9e6b7421d894146373c70a1c2&hash=CE1337B4D544BFF6531E7934FBA46C04)

Road Safety and Technical Manager Joel Tucker said more than 84% of motorists believe road rage has increased, compared to just over 74% in 2020.

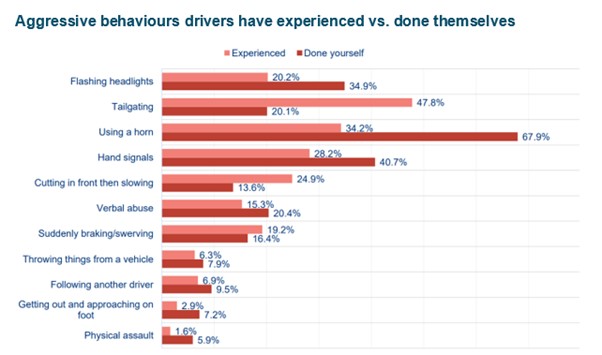

“The most common aggressive road behaviour experienced was tailgating, followed by using a horn and hand signals,” Mr Tucker said.

“We also saw an increase in drivers admitting to acting aggressively themselves.

“More than 20% of motorists said they’ve verbally abused other drivers or tailgated, 16.4% have suddenly swerved or braked and 13.6% admitted to cutting in front of someone and slowing down.”

Mr Tucker said the increase in people carrying weapons in their cars was particularly concerning.

“Alarmingly, 7.6% of Queensland motorists admitted to carrying weapons in their car, which is up from 4.8% last year,” he said.

“Put simply, there is no place for violence or aggression on our roads. Roads are already dangerous enough without road rage and we need drivers working together to ensure the safety of themselves, their passengers and other road users.”

RACQ urged drivers to think twice about being confrontational on the road.

“If you are aggressive on the road, or react to road rage with more aggression, chances are you’ll get caught,” Mr Tucker said.

“Our survey shows that nearly a quarter of motorists own dashcams and 78% of them would report aggressive drivers and hand vision in to police.

“We all get stuck in traffic, we all have places to be and sometimes we make mistakes. It’s important to keep a cool head and not to overreact to things that happen on the road, because the consequences of impatience or anger can be life changing.”

Related topics

Things to note

The information in this article has been prepared for general information purposes only and is not intended as legal advice or specific advice to any particular person. Any advice contained in the document is general advice, not intended as legal advice or professional advice and does not take into account any person’s particular circumstances. Before acting on anything based on this advice you should consider its appropriateness to you, having regard to your objectives and needs.

Insurance Products (excluding Travel Insurance) are issued by RACQ Insurance Limited ABN 50 009 704 152 (RACQI) and arranged by its agent, RACQ Distribution Services Pty Ltd (RDS) ABN 35 116 361 650, AFSL 567130 and RDS' authorised representatives (including RACQ Operations Pty Ltd ABN 80 009 663 414, AR No. 234978 (RACQO). Conditions, limits and exclusions apply. RDS and RACQO are in the RACQ group of companies. One of the companies in the RACQ group of companies has a minority shareholding in RACQI.

RDS and RACQO have not taken your personal objectives, circumstances or needs into account when preparing advice regarding insurance products and you will need to consider whether the advice is appropriate for you. Read the Product Disclosure Statement (PDS) and any applicable Supplementary PDS before making a purchase decision on this product. You can also access our Target Market Determinations on this website. RDS receives a commission from RACQI for the policies it arranges. RACQO receives fees paid for services it provides to RDS. Further details about remuneration are available on request prior to purchasing.

Banking and loan products issued by Members Banking Group Limited ABN 83 087 651 054 AFSL/Australian credit licence 241195 trading as RACQ Bank. Terms, conditions, fees, charges and lending policies apply. This is general advice only and may not be right for you. This information does not take your personal objectives, circumstances or needs into account. Read the disclosure documents for your selected product or service, including the Financial Services Guide and the Terms and Conditions, and consider if appropriate for you before deciding.

Except for RACQ Bank, any RACQ entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Cth). That entity’s obligations do not represent deposits or other liabilities of RACQ Bank. RACQ Bank does not guarantee or otherwise provide assurance in respect of the obligations of that entity, unless noted otherwise.

RACQ Bank subscribes to the Customer Owned Banking Code of Practice which establishes higher standards than the law requires. The Code reflects modern consumer expectations and developments in approaches to issues such as consumer vulnerability, guarantors, and supporting customers through financial hardship. Please read our Customer Owned Banking Code of Practice page for more information.

RACQ Operations Pty Ltd (ABN 80 009 663 414 AR 000234978) and Members Travel Group Pty Ltd (ABN 45 144 538 803 AR 000432492) are acting as an Authorised Representative of the issuer of the insurance, Tokio Marine & Nichido Fire Insurance Co., Ltd. (ABN 80 000 438 291 AFSL 246 548). Any advice set out above is general in nature only, and does not take into account your objectives, financial situation or needs. Before purchasing any travel products, please consider the RACQ Travel Insurance Product Disclosure Statement (PDS) and the Target Market Determinations (TMDs) that apply to these products. Whilst the PDS outlines the Terms and Conditions of these products, the TMDs outline the intended class of customers that comprise the target market for these travel products. This will allow you to consider which products best suit your objectives, financial situation and needs and consider the products appropriateness to your personal circumstances. TMDs also outline matters involving the distribution and the review of these products. The PDS, Supplementary PDS and TMDs for each travel product can be found here.